Cooperative Credit Union: Your Partner in Financial Growth

Credit history unions have arised as trusted allies for individuals looking for to accomplish economic stability and growth. By focusing on member-centric services and promoting a feeling of area, credit score unions have reshaped the economic landscape.

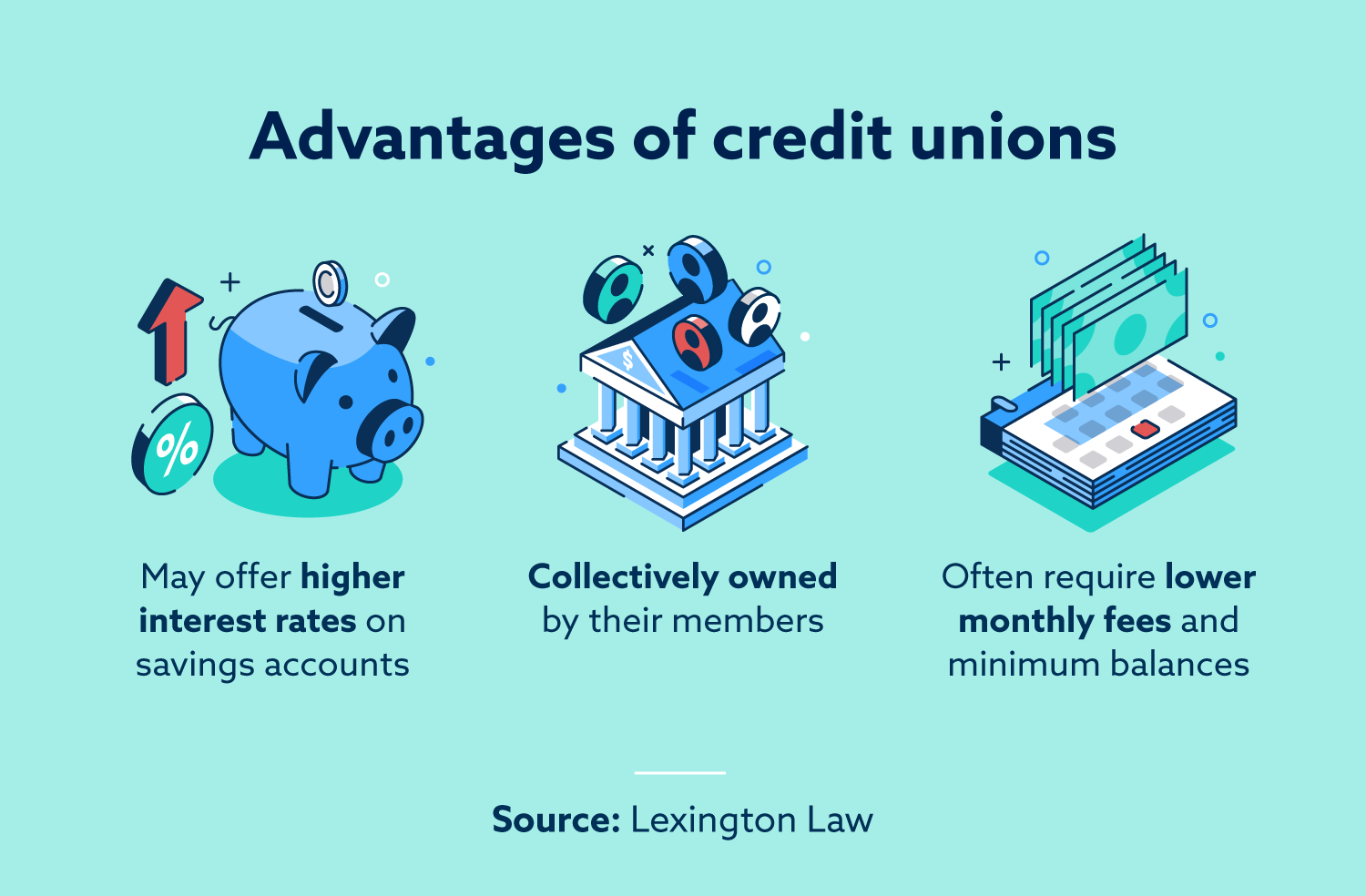

Advantages of Joining a Lending Institution

Credit scores unions provide a variety of benefits to people looking to sign up with an economic institution that focuses on participant requirements and community participation. One significant advantage is the customized service that credit unions provide.

Additionally, cooperative credit union commonly supply affordable rates of interest on cost savings accounts and finances. Since they are not-for-profit organizations, lending institution can commonly give greater passion prices on savings accounts and lower rates of interest on finances compared to large banks. Credit Union in Cheyenne Wyoming. This can lead to price savings for members gradually and help them accomplish their monetary goals much more successfully

Moreover, debt unions are recognized for their focus on financial education and neighborhood involvement. Many lending institution provide monetary proficiency resources, workshops, and programs to help members boost their financial expertise and make informed decisions. By actively engaging with the neighborhood with sponsorships, volunteer possibilities, and charitable initiatives, credit scores unions demonstrate their commitment to supporting neighborhood reasons and fostering economic growth.

Variety Of Financial Products Used

As individuals discover the advantages of joining a credit scores union, they will locate a varied array of economic products tailored to satisfy their various requirements and goals. Credit score unions frequently offer specific services such as automobile loans, home loans, personal fundings, and credit scores cards, all made to help members in attaining their monetary purposes.

Personalized Financial Support and Assistance

Participants of credit report unions benefit from customized monetary guidance and support to navigate their specific monetary objectives and obstacles. Unlike traditional financial institutions, credit scores unions focus on individualized service to satisfy the distinct needs of each member. This tailored method begins with comprehending the member's economic circumstance, goals, and risk tolerance.

Lending institution professionals, often referred to as participant advisors, work carefully with people to create individualized monetary strategies. These plans might consist of budgeting assistance, financial savings techniques, financial investment alternatives, and debt monitoring services. By providing one-on-one examinations, lending institution can provide useful understandings and suggestions details to every participant's conditions.

Furthermore, cooperative credit union focus on enlightening their members about financial proficiency and encouraging them to make educated decisions. Through workshops, online sources, and educational products, members can enhance their understanding of numerous financial topics, such as saving for retired life, enhancing credit rating, or purchasing a home. This commitment to continuous support and education sets click resources credit history unions apart as relied on partners in their participants' economic trips.

Competitive Rates Of Interest and Charges

Furthermore, lending institution are understood for their clear fee structures. Wyoming Credit Unions. They commonly have lower fees contrasted to huge financial institutions, making it more affordable for participants to manage their finances. By preventing too much charges for solutions like overdraft accounts, atm machine usage, and account maintenance, cooperative credit union assist their participants keep even more of their hard-earned money

Area Participation and Social Responsibility

Debt unions demonstrate a commitment to community participation and social duty through various initiatives and partnerships that profit both their participants and the broader culture. By offering economic literacy workshops and sources, credit report unions empower check my source people to make enlightened choices about their money management, ultimately adding to the total economic wellness of the community.

In addition to these efforts, cooperative credit union prioritize social responsibility by sticking to ethical business techniques and promoting openness in their operations. Their concentrate on serving the community sets them besides typical financial institutions, highlighting a people-first approach that aims to develop a favorable effect beyond just monetary purchases. Through their participation in neighborhood initiatives and commitment to social obligation, credit unions showcase their dedication to developing stronger, a lot more lasting communities for the advantage of all.

Verdict

In verdict, credit report unions play an important function in individuals' economic growth by using personalized solutions, affordable rate of interest prices, and a large variety of monetary products. article By focusing on the financial wellness of their participants and supporting regional causes, credit history unions develop count on and commitment that fosters long-lasting economic growth.

Several credit scores unions supply financial literacy programs, resources, and seminars to help members enhance their economic knowledge and make notified choices. Credit unions often supply customized solutions such as vehicle financings, mortgages, personal finances, and credit cards, all developed to help participants in attaining their economic purposes.

Overall, the diverse range of financial products provided by credit report unions provides to the varied demands of their participants, cultivating economic security and development.

Members of credit report unions benefit from customized financial support and assistance to navigate their specific economic goals and challenges - Credit Union Cheyenne WY. By prioritizing the financial health of their participants and sustaining regional causes, credit history unions establish trust and commitment that cultivates long-lasting monetary growth